- The Trader Reset

- Posts

- SPX Digesting a New All-Time High

SPX Digesting a New All-Time High

And me, trusting what already works.

SPX Review and Outlook

EOW Stats

High: 6,920.34.

Low: 6,814.26

Close: 6,840.19

Change: +0.71 %

ATH: 6,920.34 (Oct 29)

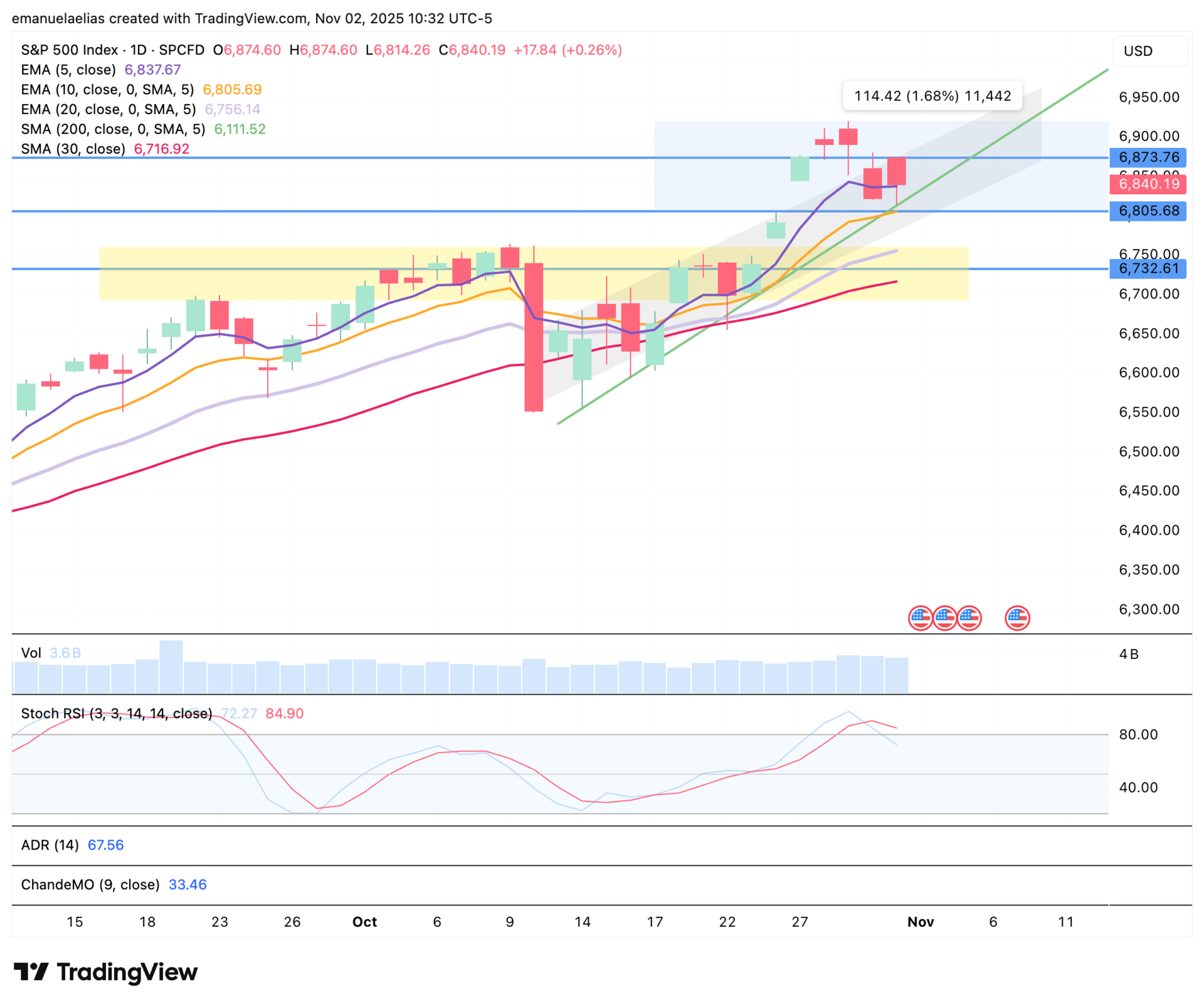

After a strong run through late October, SPX topped out at 6,920.34 on October 29 before giving back part of the move and closing the week at 6,840.19. On the weekly chart, you can see how price popped above the 6,800 zone from the previous close, climbed sharply, then met some selling pressure near 6,900. Buyers pushed, sellers stepped in, and now we’ll see whether this sets up for a bit more digestion or another leg higher.

SPX Weekly Chart

On the daily chart, Friday’s candle shows the index finding support near the 10 EMA and tagging the uptrend line that’s been in place since mid-October. That bounce from the line and back above the 5 EMA keeps the short-term structure intact. I’m leaving the rising channel on my chart for now since it still helps me picture where we might drift if we digest while moving higher, but the uptrend line has become the stronger reference point for me at the moment.

SPX Daily Chart

This Week’s Scenarios to Consider

1. Short Pause Before Continuing Up

We could see another day or two of sideways movement, maybe a light pullback toward the rising trend line before regaining strength. That would keep SPX in the upper half of the channel and still aligned with the broader uptrend. A push back above 6,873.76, which rejected price on both Thursday and Friday, could confirm continuation and open the path toward a new all-time high.

2. Immediate Push Toward New Highs

If buyers step in early in the week, SPX could stay pressed to the upper half of the channel and climb through 6,900–6,920, creating a sharper uptrend and possibly printing a new high even if it’s brief.

3. Deeper Pullback

If the index can’t hold 6,800, a normal retrace could reach the 20 EMA (around 6,750 – 6,760), which SPX often tags during strong climbs before another leg higher. Anything deeper, roughly 6,700–6,720, would bring the 30 SMA into play, though that still feels less likely given we just visited that zone in mid-October. I did jot down a reminder that price can undercut an uptrend line without invalidating it, so if we do decline, I’d like to see follow through before calling it anything more than a pullback. The weekly chart is extended, and the SRSI isn’t confirming the new high, reflecting a bearish divergence between price and momentum.

For now, everything still points to healthy consolidation within an uptrend. The mid-October trend line continues to hold, and as long as we’re staying aligned with it, these pullbacks look like the market catching its breath before the next move.

Returning Home

I’ve been spending this past week returning to myself. During my drawdown, I kept trying to fix it, studying other people’s systems, folding in ideas that weren’t mine, crying when none of it worked. About two weeks ago, something shifted. I realized I didn’t need to fix anything. I just needed to come back to what I already know and trust in my own process.

So this week I’m leaving you with a few thoughts that have been floating around.

Stop losses.

Yes, I said it. A few newsletters ago I mentioned I wouldn’t use them for options, but I’ve changed my mind. I like to put on size, and I don’t have the privilege of doing that without a stop in place. This is something new, and I’m still collecting data to see if it truly supports my shift, but I’m already noticing that having a stop loss in place helps me refine my entries. For now, it’s working.

Trading Less.

Fewer positions keep me calmer. Too many trades at once make everything feel noisy, and when a few start pulling back, fear takes over. I’ll sometimes close them all instead of assessing which are still viable. The practice of passing up trades has been grounding, and reminds me there’s always another opportunity.

Timeframes.

I always believed I was a daily-timeframe trader, but lately I’ve been wondering if the 4h chart may actually suit me better. The thought of shifting down a timeframe came from asking myself what I can put in place to keep my nervous system steady and help me sleep at night. Most of the time I take profits before any major pullbacks (2ish + red days in a row). I can’t always anticipate when those happen, but I’ve noticed I tend to trade one leg at a time on the daily timeframe. Moving down to the 4h may give me clearer information for my exits while still keeping the daily as my anchor.

A few things I’ve jotted down this past week:

Money is energy. It can bring freedom or chaos. Notice if it’s flowing in with peace or with tension.

Suffering invites us to look closer at what we need.

The brain is built to confirm what it already believes. I’m learning to pause when it tries to prove what I can’t do and remind myself that belief isn’t always reality.

I don’t have everything figured out, but that’s where I am right now, taking care, paying attention, and slowly finding my way back to center. Thank you, as always, for being here and reading along. ‘Til next time!