- The Trader Reset

- Posts

- Seasonality as Part of the Puzzle

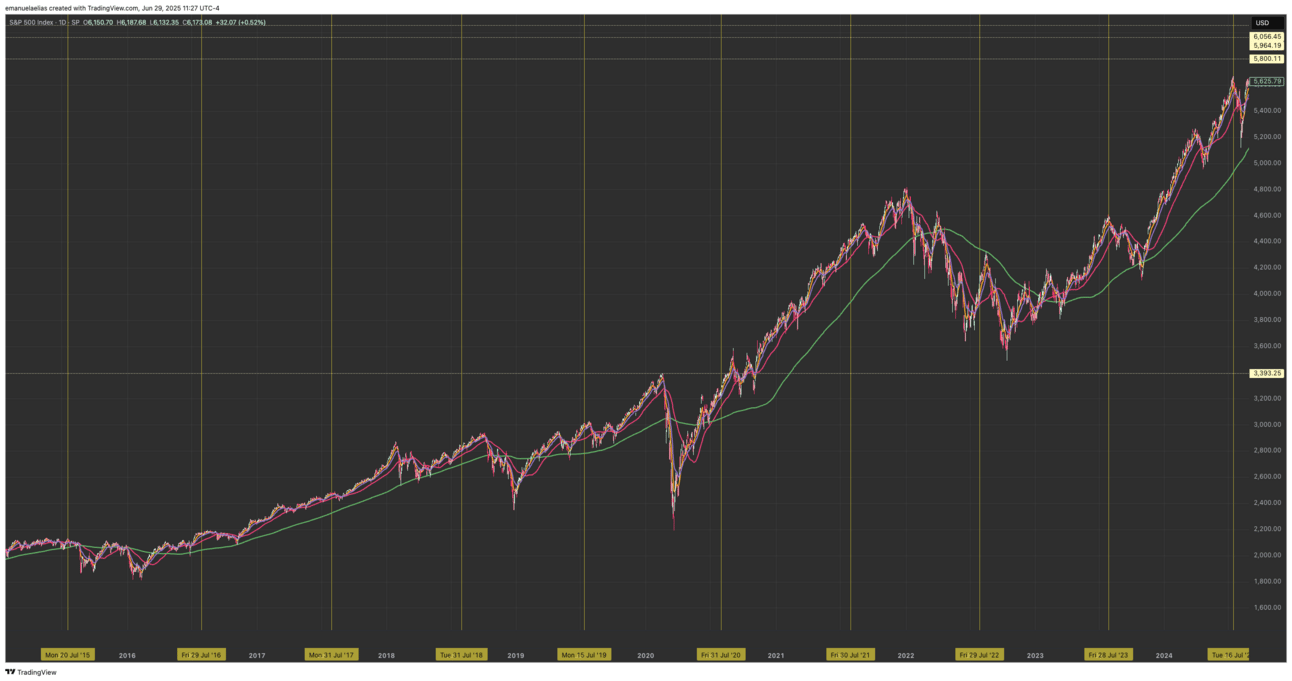

Seasonality as Part of the Puzzle

July's Historical Movement

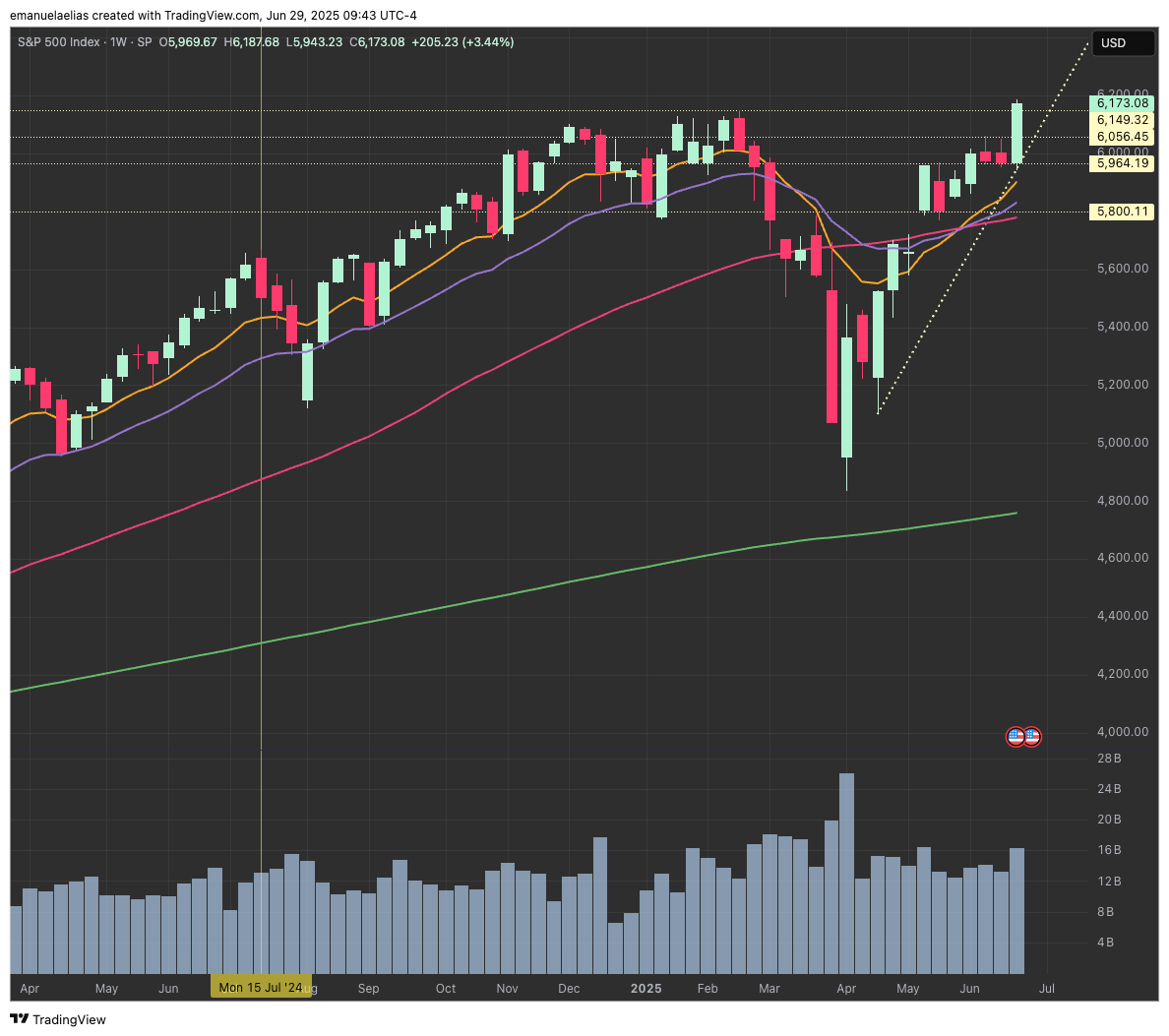

SPX Outlook

Last week, the inside bars on the weekly chart resolved to the upside with a breakout to new all-time highs. It was a sweet textbook example of expansion following compression. We’re now back in uncharted territory, with no overhead resistance and strong momentum behind the move.

We’ve had a clean ride up since Tuesday on the daily chart, and the weekly candle closed strong (wide-range, high-close, and backed by volume). The trend is clearly intact. Being at all-time highs doesn’t automatically mean we need to pull back, but if we keep climbing at this pace, a digestion would be normal. Not because of the ATH itself, but because strong directional moves need time to reset.

What stands out right now:

Weekly Chart

Wide-range candle with a close near the high, buyers showing strength.

Volume picked up on the breakout, another sign of buyer control.

Price is riding above the 10EMA, with the 5EMA (not pictured) acting as a guide in strong trends.

No signs of weakness yet, no failed breakout, no loss of support, no change in trend.

SPX Weekly Chart

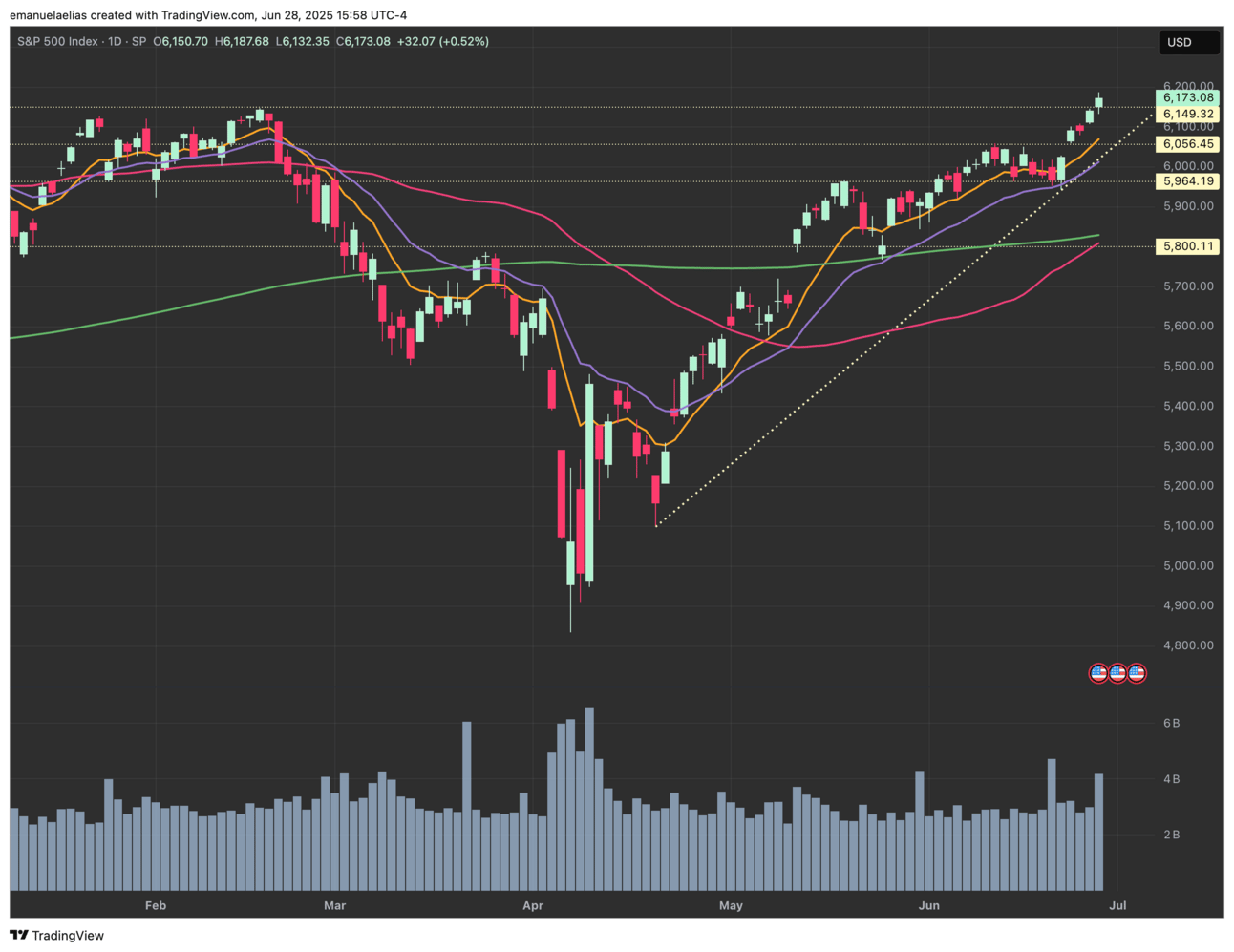

Daily Chart

Tuesday’s breakout led to a steady, directional move with no real backtracking.

Price is currently extended from the 10EMA, but riding the 5EMA cleanly.

Until there’s a shift in character, like a failed breakout or heavy reversal, buyers remain in control.

SPX Daily Chart

Seasonal Context - The Month of July

July tends to be a strong month for the S&P 500. If we look at the past 10 years, the index has often continued higher through at least the first half of the month.

In the years where July does include a pullback, it usually doesn’t show up until the second half of the month.

Momentum typically starts to slow mid-to-late month, with more pronounced corrections or volatility spikes in September and sometimes August.

While the trend remains bullish now, it’s worth keeping the back half of the month in mind. The stronger and more extended the early July move is, the more likely we are to see a pullback as the month goes on. (This point only assumes we get another week or two of a rise!)

2015: Pulled back late July, then stayed range-bound

2016: Breakout early in July led to a strong run that topped (but didn’t reverse yet) mid-month

2017: Bottomed the first few days of July, then continued higher

2018: Steady upside throughout July with a short pullback to EMAs at the end of the month

2019: Chop started mid-month, followed by a decline that began at the end of July

2020: Consistent climb throughout the month, no significant pullback

2021: Mid-month dip, then resolved higher and closed the month up

2022: Strong continuation through July, with a short pullback mid-month

2023: Continued higher through late July, then rolled over in August.

2024: Consistent climb in the first half of the month, followed by a sell-off in the second half.

For now, I'm leaning bullish while staying cautious and flexible as we move through the month.

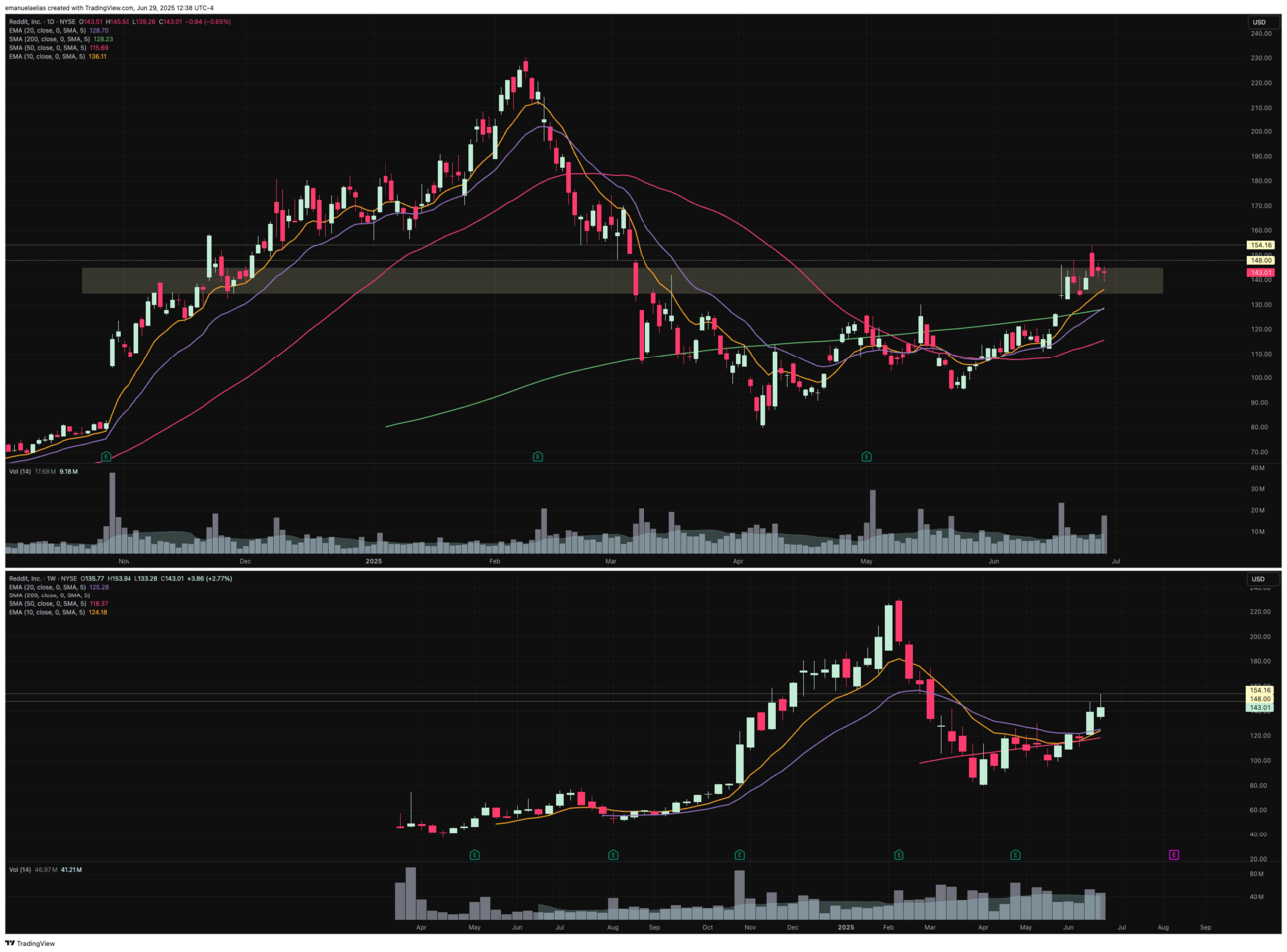

RDDT Update

Ahhh! Last post on RDDT before a new stock pick for July!

On June 17, price spiked up intraday to $146.16 before getting rejected, leaving a long upper wick on the daily.

Since then, RDDT has mostly stayed in that range, between roughly $134 and $146.

The last three days of last week, price broke above that zone, tagged $154, and then drifted back down.

That candle from June 25 was a bearish one, and the two days that followed formed inside bars within it.

RDDT Daily and Weekly Chart

Now we’re just waiting to see if this digestion resolves up or down, and whether price reclaims momentum to break to new recent highs (not all-time highs), or if it loses that range and pulls back further.

On the weekly chart, the 10 EMA is just about to cross above the 20 EMA, and the moving averages are starting to get in order again. This crossing is a bullish signal, or at least supportive of an ongoing climb. If the overall market momentum remains strong to the upside, I could see another leg up!

I wish you all a strong close to June and looking forward to Q3!!

And P.S. If you know someone that may be interested in my newsletter, I’d love it if you forwarded it to them. I’d love to grow my readership!

Thanks so much for tuning in. ‘Til next time.