- The Trader Reset

- Posts

- Range Bound, Breaking Out, or Breaking Down?

Range Bound, Breaking Out, or Breaking Down?

SPX levels and behaviors to check for this coming week.

Up & Coming Workshop!

I’m hosting a free Trading Plan Workshop inside my community where I’ll walk through how I built the structure that led to my first six figures, and how you can start building your own.

Members also get access to free live AMAs, a space to bring trade reviews, questions about your plan, risk decisions, execution patterns, and anything you’re working through right now.

Join my community here!

SPX Review and Outlook

📹 A video version of the info below can be found on TradingView.

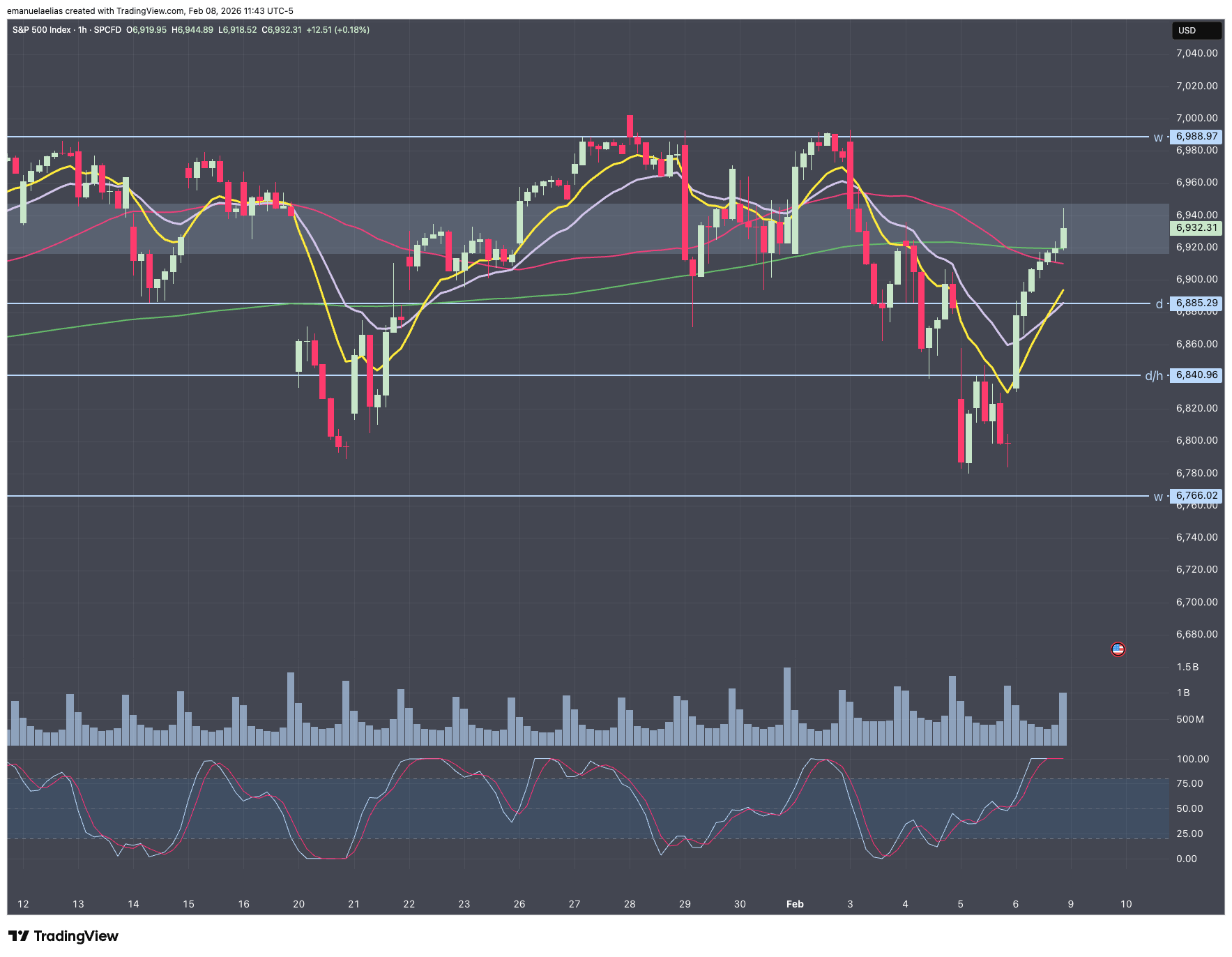

SPX remains range-bound on higher time frames, with price rotating between clear weekly levels rather than trending cleanly. Last week we sold off for three days into the lower weekly band around 6,766 to 6,790, and then buyers stepped in strong on Friday, which showed continued demand at the bottom of this range.

Now the focus shifts to follow-through, because what happens as price pushes back toward 6,988 to 7,000 is going to tell us whether we are just rotating inside the range again, or whether the market is starting to a new higher weekly zone.

SPX Weekly and Daily Chart

Scenario 1: Buying continues, then stalls around 6,988 to 7,000

If Friday’s buyers get follow-through early in the week, my first area to assess is how price behaves around the upper weekly band at 6,988 to 7,000. If we push into that zone and fail to hold, that may mean the range remains intact and we are still in rotation mode. In that case, the market will work its way back down through the range, because the upper band is still acting like supply.

Key things I’m watching:

A push into 6,988 to 7,000

Failure to hold above that zone on the daily

Rotation back down toward 6,766 to 6,790

Scenario 2: We break the lower weekly band, deeper range opens

If we rotate back down and price returns to the lower band around 6,766 to 6,790, then the question becomes whether buyers defend it again. If we break that lower weekly band at 6,766, this opens the door for a deeper move toward 6,525, resolving the range we’ve been in to the downside.

Key things I’m watching:

Price losing 6,766

Follow-through selling after the break, rather than an immediate reclaim

Risk of a weekly or multi-week move toward 6,525

Scenario 3: Bulls stay in charge, acceptance above 7,000

The weekly chart is still bullish, and last week we tested the weekly 20 EMA, so the bulls still have a strong case if they can build on that support. If bulls are still in charge, what I want to see this week is acceptance above the upper weekly band, meaning a sustained hold above 6,988 to 7,000 rather than a quick pop and fade. That would signal graduation into a higher weekly range, and in that environment pullbacks start acting like support zones rather than rejection points.

Key things I’m watching:

Sustained hold above 6,988 to 7,000

Pullbacks staying supported (higher lows) above the prior upper band

Higher weekly range behavior, where we stop revisiting the lower band as easily

Hourly zoom-in

Price just pushed into the shaded daily zone I have marked around 6,918 to 6,950, and on Friday we saw a small pause near the top of that area. That little bite of sellers near the close could mean a retest is coming, but the timing and shape of it is still an open question. We could see continuation higher without an immediate retest, a shallow retest that holds quickly, or a retest that comes later rather than right away. This is why day by day, timeframe by timeframe, we assess what price is doing instead of pre-assigning a pattern.

Hourly Zoom In

Inside that shaded zone, I treat 6,920 as the area that can act like support and 6,950 as the area that can act like resistance, since both show up on the hourly and daily. If we do get a retest, 6,885 is the first zone where I’d check for buyers and see if we can base and rebuild. But price may not come back there right away, or at all, and instead keep building higher before pulling back later.

If 6,885 fails to hold, that’s when I’d consider a choppy, or potentially more bearish scenario.

That’s what I’ve got for you today! As always:

Read what’s in front of you.

‘Til next time!