- The Trader Reset

- Posts

- I see you RDDT

I see you RDDT

RDDT out of its base, and SPX clocking in a second flat week.

SPX Outlook

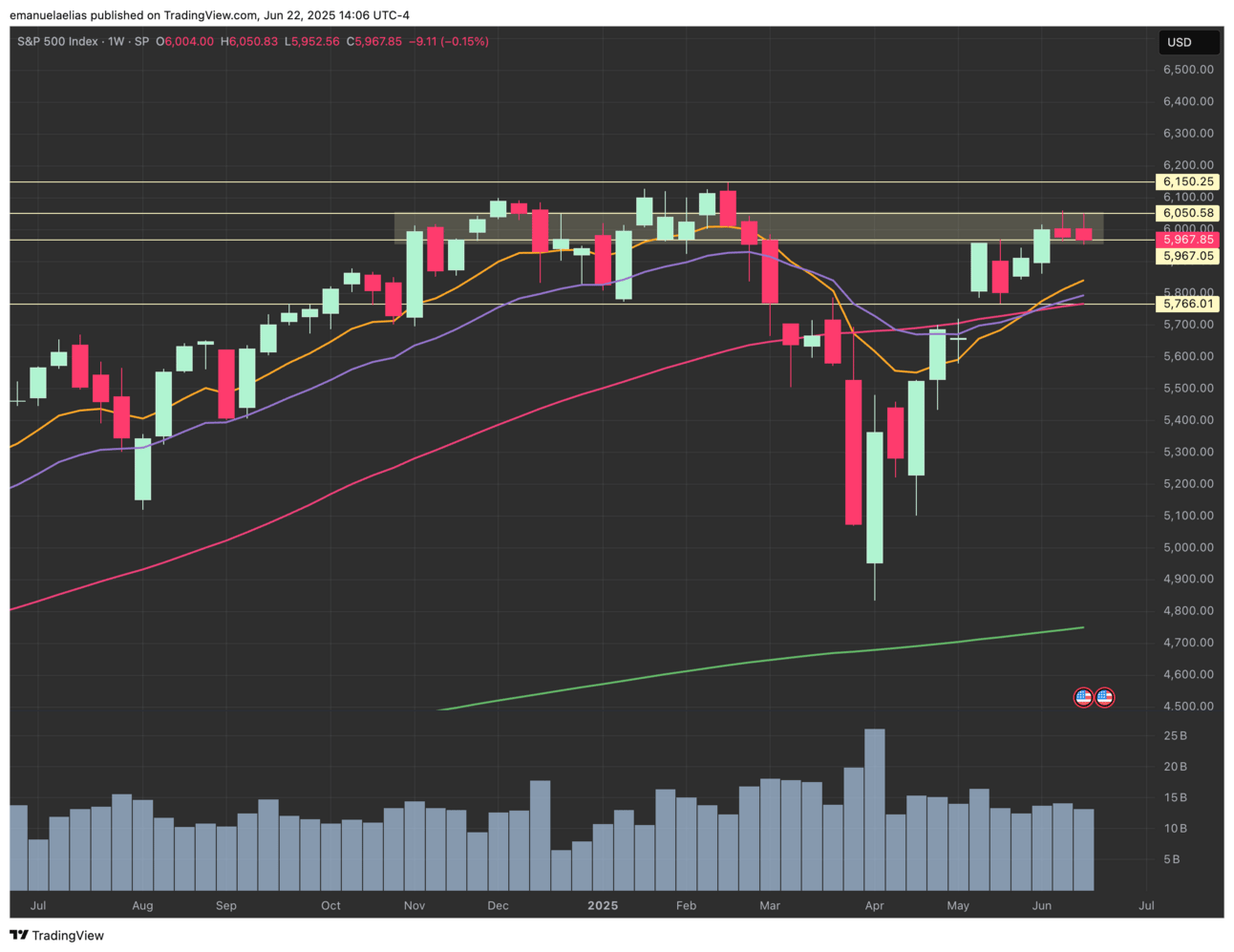

Zooming out to the weekly chart we can see we’ve now formed two inside bars in a row, sitting right at the upper end of this recent move. The price has been hovering here without much progress.

SPX Weekly Chart

Here’s what what to note:

The last two weekly candles are inside bars. This kind of structure tends to precede a larger move.

An inside bar forms when the entire range of a candle fits within the high and low of the previous one. It reflects short-term indecision or a pause in volatility. Typically this kind of consolidation can precede expansion, but the direction isn’t implied. Inside bars are most useful when they form at key areas, like near support, resistance, or major trend pivots, where a break in either direction could carry more weight.

Price rejected around 6050, and found support both weeks around 5960.

The tight range and flat movement the last few weeks tells me we’re compressing near the highs. Buyers haven’t stepped in aggressively, but there hasn’t been any major selling either.

The area I shaded is where the index consistently chopped from November to February. We are stalling there again, not rejecting, but not clearing it either.

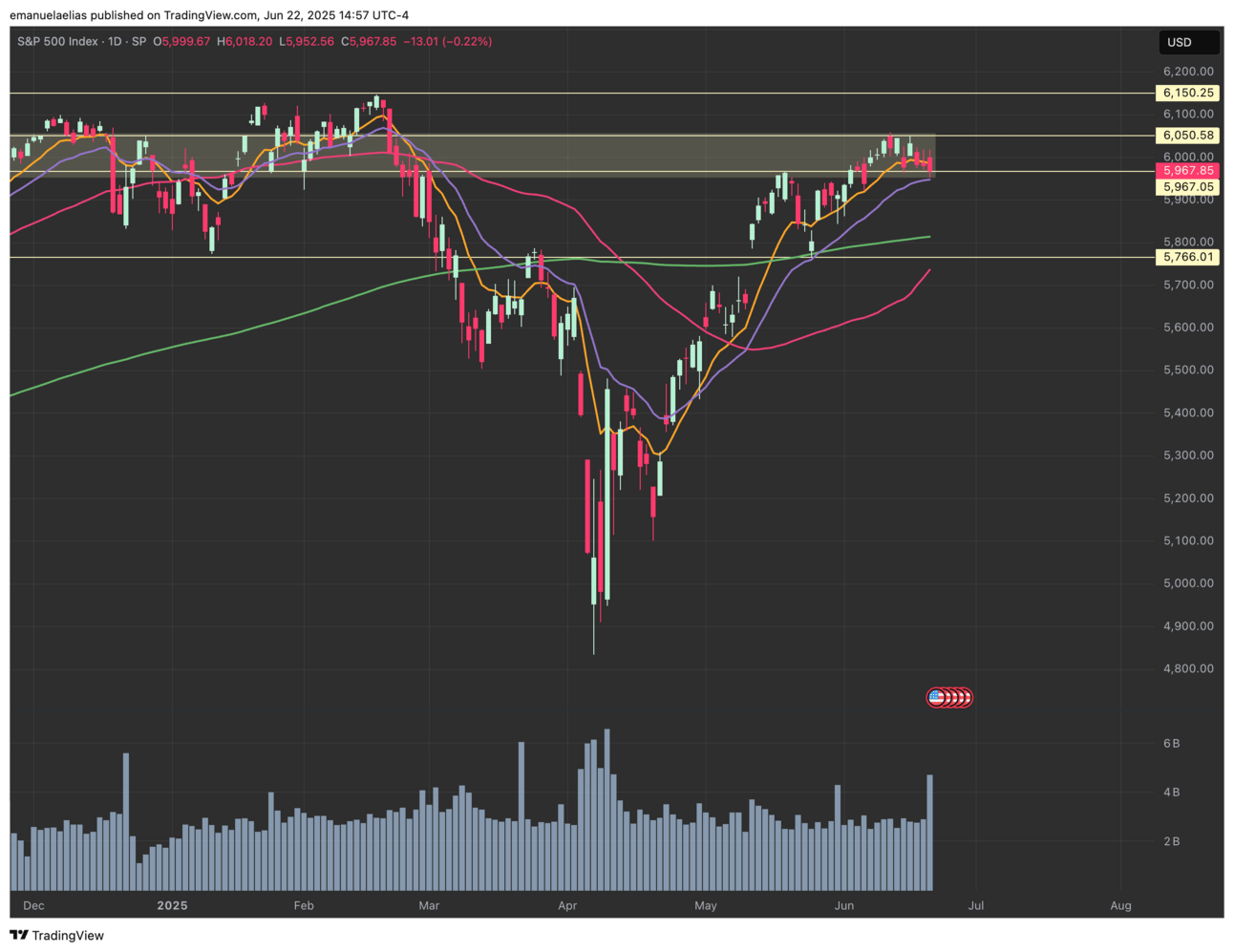

On the daily chart, price is still sitting above the 20EMA. There was a spike in volume on Friday, but it didn’t come with a meaningful move, which usually just signals positioning or expiration-related activity, not a clear change in trend.

SPX Daily Chart

This week I’m watching to see if SPX holds the 20 EMA. A move above 6050 would break us out of the range and open the door back toward the all time high. A break below the daily 20 EMA, could tumble us back toward the mid May gap up around 5800. I am actually leaning toward a decline into a deeper base (not just the somewhat flat base we are in now). I still have some calls on though, so if that’s not the case, I’m in there already.

RDDT Recap

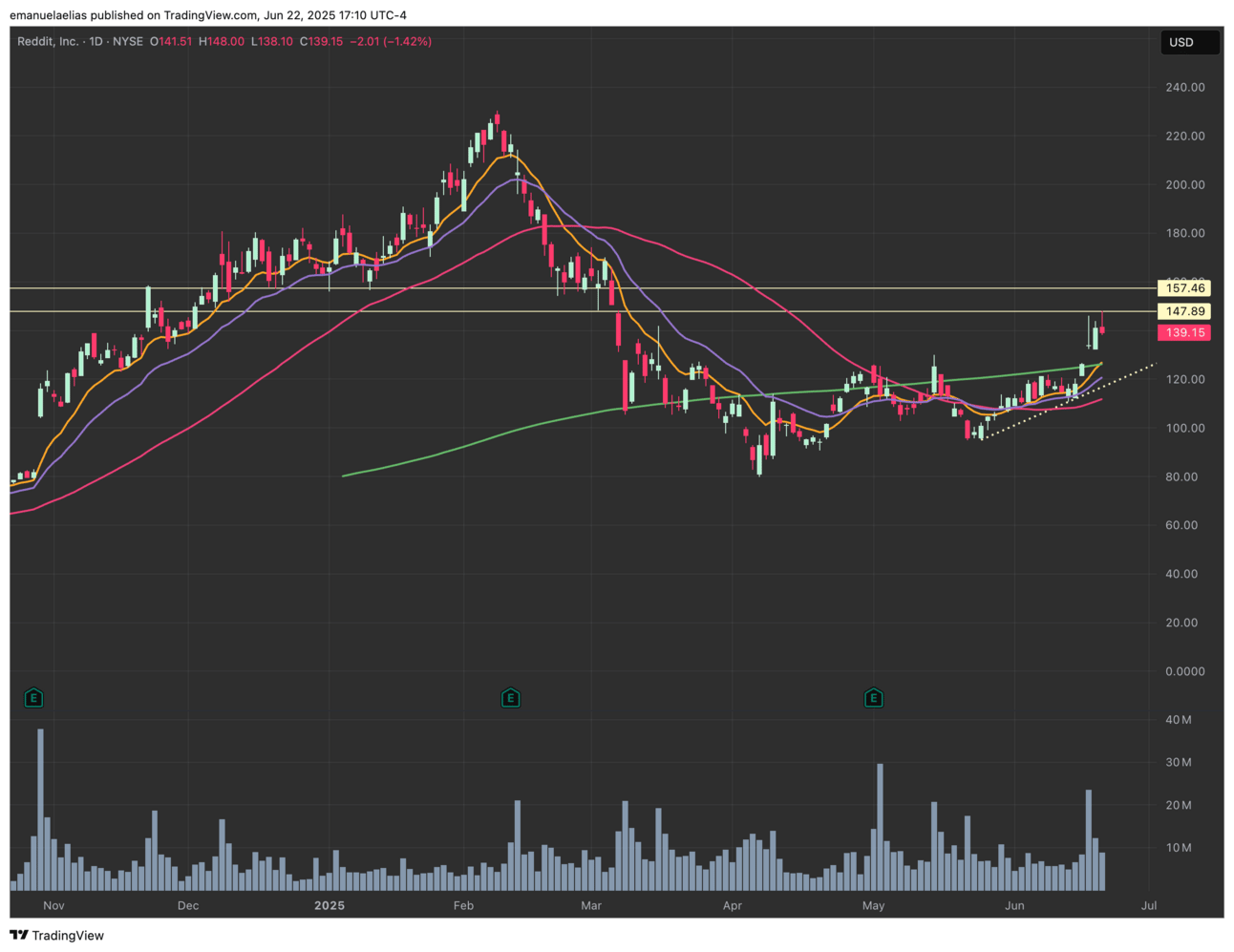

RDDT finally broke out of its base as I was just about to give up on it last week. I had bought a position on the 6th and added to it on the 10th, but the drifty sideways was annoying. The breakout started to take shape on the last Thursday and Friday of May. From there, it drifted back down and retested the daily moving averages, right around June 12 and 13 (a better place to have bought, but that’s retrospect). After that retest, it rallied again and topped out at 148 on Friday, before pulling back.

RDDT Daily Chart

Here’s what stands out to me right now:

The high at 148 lines up with a temporary support zone from the February–March decline, and also shows up on the chart back in November–December as a short term rejection area that then turned support. There’s memory in this zone.

A continued pullback, even if it’s drifty and sideways, wouldn’t be surprising especially because we are extended from the 10EMA.

If momentum stays strong, that digestion could be short. If not, I wouldn’t be surprised to see another week or so of sideways movement while the move settles.

If we get back into gear, the next big zone to watch is 157, which was the support level going all the way back to December 2024, right before the explosive Jan-Feb run. It also acted as a pause zone during the Feb–Mar decline this year, so it’s still relevant.

As for me, I got in a little early on this one, but I had time on my contracts so it worked out. I scaled out a few of my contracts at the first gap up around 100% profit, and then scaled out of the majority of my position around 300% profit on Friday, leaving a few runners on. But I don’t mention this to brag, but to share how I felt at first.

Because I gave back some profits earlier this month by overtrading, this big (to me) win was initially overshadowed by the gap mindset I had. The Gap and the Gain is the title of a book and framework by Dan Sullivan and Dr. Benjamin Hardy. The gist is that we can either measure ourselves against some future ideal (the gap) or against where we’ve come from (the gain).

Staying in the gain takes practice, like me recognizing the recovery itself, the regained clarity, the progress that’s already happened, not just the profit that could’ve been. And because I have huge goals, I was focused on how much further I want to go, instead of pausing to really take in how far I’ve already come. This year I’ve been doing well. And while June may not be my best month, I’m grateful to have stabilized and to have another opportunity to be in a better position next time I call a breakout correctly. I look forward to that win next.

So a reminder to you, (and myself, always 😂)…living in the gap is a killer of joy. It will rob you of the very progress you’ve worked so hard for.

As we go into this week, take inventory of how far you have come and use that energy to continue to propel you forward. ✨