- The Trader Reset

- Posts

- Chasing Wholeness

Chasing Wholeness

Learning to Evolve from Revenge Trading

Pattern Interruption

I’m in the process of evolving my relationship with revenge trading. I’ve been avoiding the word fixing because I’m tired of the concept of needing to “fix” myself. We are who we are. There are things that trigger us and things that we chase. When we understand what those things are, and understand that they’re not inherently good or bad, we move toward acceptance of our whole selves.

In order to reach our goals and desired outcomes, we have to evolve our relationship with fear and the triggers and impulsive behaviors that surface when we feel uncertain or afraid. The evolution itself is what creates our desired result, whether it’s a certain account balance, a level of physical fitness, or a deeper connection with a loved one.

Accepting where we are, regardless of where we’ve been, is part of the first step toward being in control of ourselves versus letting our fear overrule us. The other part of that first step is naming what is important to us. What precedes this “addiction” or “impulse”? What is being threatened?

For each of us, the answer to what is being threatened, is different. For me, it’s freedom and competency. Every time I give back profits, I am inundated with thoughts and feelings that my choices are being restricted, and that I don’t know what I’m doing. But nothing in my life has changed. I still have the same circumstances, the same opportunities, the same resources, and I still have all the knowledge that has allowed me to be profitable YoY. It’s not that I’m suddenly trapped or have gotten dumber, it’s that I am no longer anchored to the feeling and the state of freedom and competency.

If I can stay connected to that inner state of freedom and competency, regardless of what my trading account is doing, it puts me in the right frame of mind to act within my structure and trust myself again. The goal for me right now is simple: interrupt the thought pattern before it turns into action from that thought pattern. The spiral starts in the mind, not the market. When I can interrupt those thoughts early, I can return to clarity and self-trust before I do damage.

Here’s a framework I’ve been working on that’s been helping me in real time.

Pattern Interruption — a simple framework I’ve been practicing

1. Awareness – Naming the Feeling and the Threat

Example: “This loss takes me further away from my account goal. It hurts. I don’t know what I am doing. I suck. This loss is threatening my identity and my freedom.”

Naming what’s happening highlights the stories and thoughts I am creating from my fear. It reminds me that the pain isn’t really about the trade, it’s about the threat to what matters most to me.

2. Grounding – Interrupting the Loop to Come Back to Wholeness

Once I name it, I pause and ground myself in my truth: I am whole, I am competent, I am profitable, I am free.

When I’m unable to ground right away, when those “mantras” feel fake and I don’t resonate with them, when I want to punch someone and be like fck you, when I want to throw an emotional tantrum…I first step away, breathe, move my body, or do something completely outside of trading. Swapping an action within of my trading account for an action outside of it, has been helpful so far.

3. Structure – Taking an Action That Supports What Matters Most

When the emotion settles, only then do I take action. I return to my rules and risk management. This structure that I’ve put in place, has been proven time and time again to move me toward my bigger goals. When my fearful thoughts have been interrupted, I can execute my plan with ease.

Right now my goal is not to build my account back up to my personal all time high, but to help myself recognize the moment before I spiral.

Interrupting my thought patterns before I take an action gives me a chance to take an action rooted wholeness versus fear. I want to notice what’s happening and pause long enough to breathe and choose one different action. That intentional choice, however small, breaks the illusion that I’m powerless. Whatever it is I’m seeking, already lives within me and each interruption is an act of remembering my truth, a quiet way of saying, I’m ready to return to myself.

SPX Review and Outlook

EOW Stats

High: 6,750.87

Low: 6,641.00

Close: 6,715.78

Weekly Change: +1.08%

ATH: 6,750.87 (Oct 3)

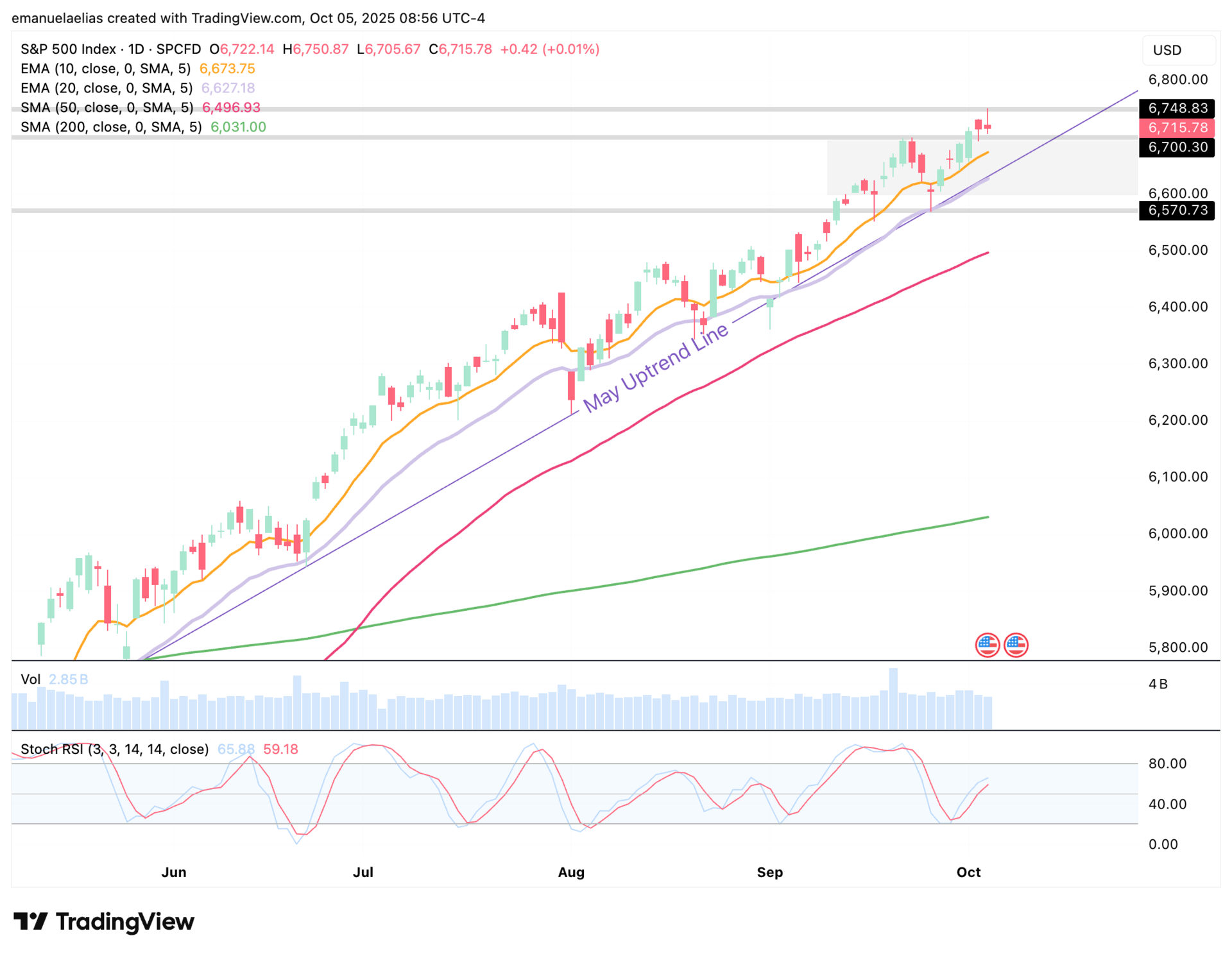

There’s nothing particularly new or standout this week. We’re still in a clear bull market. After the correction earlier this year, SPX has climbed roughly 10% since the February high near (6,147) to Friday’s close (6,715). It’s been a steady rise along the May uptrend line, and on the daily you can see how consistently it’s tested the 20 EMA, sometimes undercutting briefly, but each time recovering and continuing higher.

Last Thursday, September 25, was another example of that same pattern: a tap of the 20 EMA followed by another move up. We also set a new all-time high this week at 6,748.83, which isn’t surprising given the broader strength.

SPX Daily Chart

The shaded area between roughly 6,600 and 6,700 is where the index consolidated through mid to late September before breaking out on October 1. If we do slow down, that zone could easily act as a digestion range before another leg higher.

I’ve also added an oscillator indicator (the SRSI) to my chart to have another lens on momentum. You can see SPX making a higher high while the SRSI hasn’t, which can sometimes point to short-term divergence. This doesn’t necessarily mean a reversal, it just hints at the potential for a pullback or sideways cooling before continuation.

A Few Paths I See

Continued climb:

Price continues to grind higher along the 10 EMA, possibly extending the rally a bit more before any meaningful pause.Sideways digestion:

SPX spends some time chopping between ~6,600–6,700, digesting recent gains within that shaded zone. This can include a pullback toward the 20EMA.Deeper pullback:

If we see more sustained weakness, the 50 SMA around 6,500 could be the next logical area of support, which is a 3–4% decline from current levels.

Final Thoughts and Notes

A lot of what I was journaling on this week has been about distraction and being careful to not let the pursuit of something create the illusion that I don’t already have it. As we work toward our bigger goals and dreams, I think it’s important to stop and recognize that what we want, we already have in so many other different forms. I am by no means saying not to work toward your goals, but definitely stay intentional and do not let life move forward while you are head down chasing illusions of what you don’t have.

I am back to recording videos on YouTube, and you can see my latest one here!

Lastly, I did enter a new position on AVGO last week, and I will share via video what that trade looked like after I close it in full. AVGO popped above daily moving averages but came back to test them pretty quickly. This could be short term sellers closing their positions at break even that were previously losing, AVGO not ready to rise, or simply a retest. I will let it unfold and report back.