- The Trader Reset

- Posts

- Are You Addicted to Trading?

Are You Addicted to Trading?

How to Increase your Awareness and Break the Cycle

Are you addicted to trading?

I was.

I thought I was full of resilience and drive. Like an athlete with an obsession to win.

Then I started working with Hannah Westphal, and realized it wasn’t just that. Hannah is a neuroscientist and nervous system educator who supports people in understanding how nervous system responses influence decision making and behavior. She helped me see when my nervous system was in the driver’s seat, the pressure, the spiraling thoughts, the impulsive decisions. She also gave me tools to regulate, so I could trade from a regulated state instead of a compulsive one.

Not even a month into my work with her, I realized most of my time was being spent in obsessive thought loops, not the intentional work that would actually take me where I want to go, like studying, refining my process, and doing tons of review and practice. Instead, I was trying to hit certain profit milestones, trying to soothe my emotions, and trying to get a grip on myself, because “if I could just be profitable, or reach 200K in my case, then everything would be fine.”

But that’s not how a professional operates, whether it’s an athlete or anyone building a skill. The obsession isn’t with the outcome, it’s with the work, with the process, and with getting just 1% better.

Recognizing my addiction to trading changed everything.

So what does addiction look like in trading? Hannah shared it in a way that made it easier to see. It can be subtle, and you may not realize you’re in it until you’re deep in the loop.

The Reward-Loop of Trading

by Hannah Westphal

As many traders have already recognized, a lot of their work has similarities to gambling. A mixture of strategy, intuition, and luck is needed to sustain profitability.

The problem: trading can activate the same neural circuits of reward and impulsivity that can be found in gambling-like behaviors which can lead to a loss of clarity and control of conscious trading decisions.

This is why many traders find themselves being pushed by their nervous system into overtrading, chasing trades, or experiencing difficulties with stopping.

Understanding how the nervous system reacts under pressure can help traders:

Recognize impulsive or even compulsive patterns

Stay regulated throughout the day

Make more clear and strategy-informed decisions

In a high-stakes environment like trading, mental clarity can only be maintained if the trader understands the correlation of the market to one’s own emotional reactivity, and learns how to manage these.

Many traders fall into something neuroscience calls the “reward-loop”. It is a cycle in which the “wants” and “needs” of the brain are hijacked by stress and dopamine releases through the wins and losses of the day, and therefore bypass the conscious decision making process in the prefrontal cortex leading to automatic behavioural patterns that can feel hard to control.

The nervous system associates trading with a cycle of:

Tension → Relief → Tension → Relief

A cycle that is highly reinforced by our neurobiology.

Our brain is wired to release dopamine way before we act. This is a dopamine release by pure anticipation of a possible outcome. In this case it means that the trader gets a dopamine hit before they even trade. Because of that dopamine hit, the body starts to enter into a state of arousal.

Often arousal can feel like readiness, or being hyped up. But on a biological level it means that the body is entering a state of fight or flight - releasing stress hormones and adrenaline. This blocks access to areas of the prefrontal cortex - the decision making part of the brain. When the body is in fight or flight it is primed for fast action and not for calm, analytical thinking and strategic decision making.

But here is the thing: dopamine release is not only reinforced by anticipation but also by unpredictability. Uncertainty can create a bigger dopamine response in the brain than a predictable outcome.

This is why many feel so “alive” in those moments of unpredictability. The more dopamine is released, the more the brain wants of it. In this case it means it gets hooked to the uncertainty of trading - not only the outcome. It stays in the rollercoaster of uncertainty.

If a trade wins - Dopamine spikes again and the loop gets reinforced. The brain is screaming “do it again!”

But what happens if the trade loses? Here is the interesting thing:

It also releases dopamine, because a loss is connected to the feeling of stress and relief as the high-stress moment of flight or flight activation has a possible end in sight. However, while there is a sense of relief the stress response to a loss is still high and this in turn can lead to impulsive decision making.

In situations of high volatility, in high-stakes environments, the states of the nervous system and of the body are dysregulated. The mind is reactive and as a result of stress and dopamine bypassing the prefrontal cortex - logic becomes secondary.

The states of the body have taken control over decision making and behaviour.

The brain remembers the emotional rollercoaster. It does remember how good the dopamine felt - in relief and in unpredictability and it starts to crave to feel it again.

And the loop starts again.

I was at the point of stepping away from trading for the sake of my well being. The emotional impact was all consuming.

I’ve gotten support in the past, but this was different. I was stuck in a sneaky loop I couldn’t name until Hannah helped me see it, and it felt like it cut through the noise and went straight to the source. Now I don’t feel crazy or consumed. My nervous system understands there is life beyond the charts, and I can see a sustainable path toward my dream. I’m grateful I didn’t have to give trading up.

Working with Hannah

Starting January 15, Hannah is running a 30 day neuroeducation challenge for traders who want to understand and interrupt reactive decision loops under pressure. Click here for challenge details, or to email Hannah about 1:1 support.

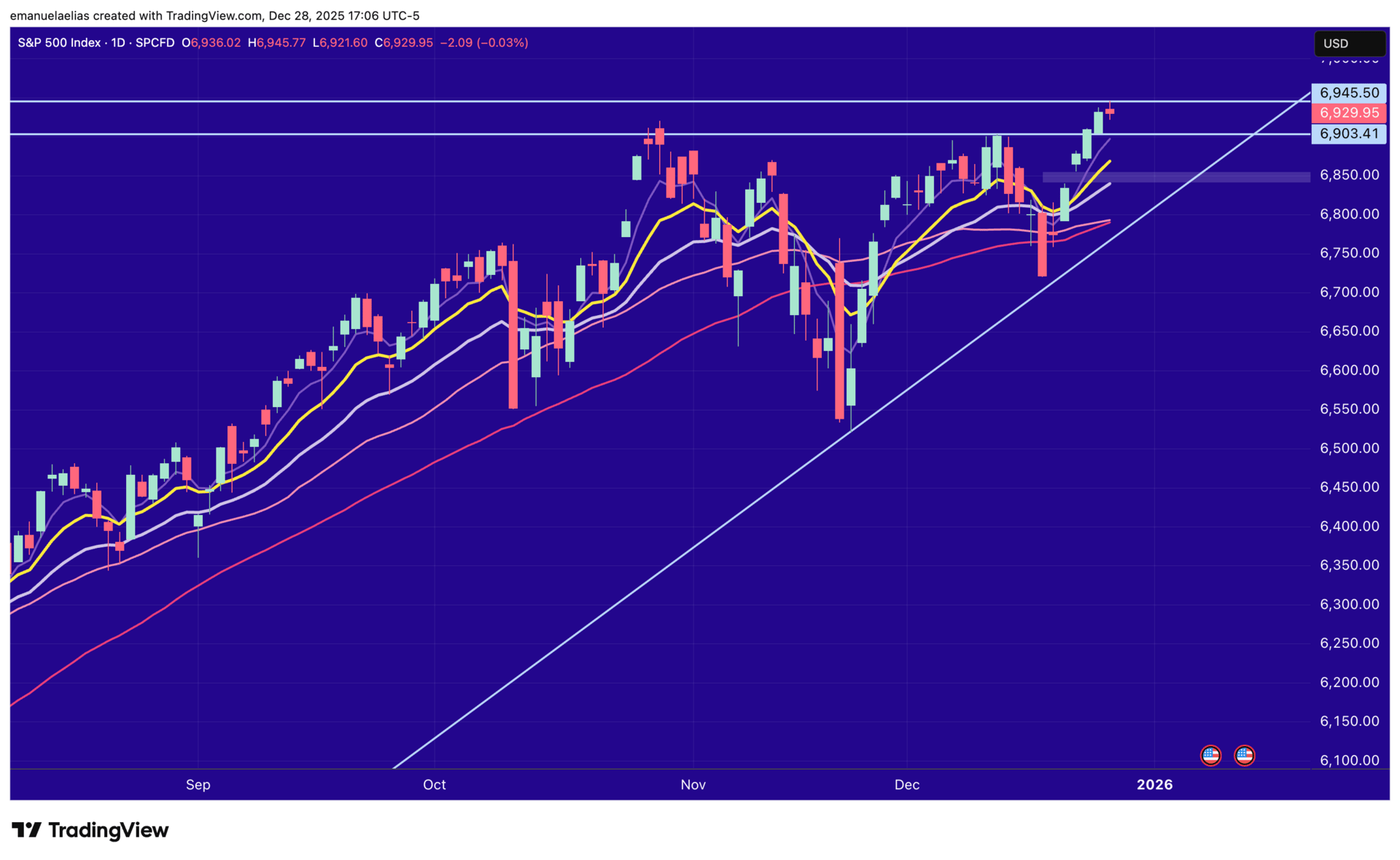

SPX Review and Outlook

EOW Stats

High: 6,945.77

Low: 6,855.74

Close: 6,929.95

Change: +95.46 (+1.40%)

ATH: 6,945.77 (Dec 26)

SPX made a fresh all time high on Friday before pulling back modestly into the close, keeping the broader uptrend intact while setting the stage for potential digestion.

SPX Daily Chart

Ideas for the Week

I’m still leaning bullish here. We’ve been rising since mid December, and that alone doesn’t mean we’re about to roll over, but we’ve covered a lot of ground, so some digestion this week would be normal. That could look like intraday pullbacks while the week still drifts higher, or a push higher first and then some chop as price catches its breath. The other path is momentum simply stays intact and we keep grinding up.

Levels I’m watching

6,900, first support. Holding above it keeps the move constructive.

6,840 to 6,855, my “normal pullback” zone, shaded in gray. This area lines up with a potential retest of last week’s gap up and sits around the daily 10 and 20 EMA. If we dip into this area and price action aligns, this is where I’d be looking to buy.

If we make new highs, I’m watching daily behavior more than a specific upside target. A few consecutive red candles or faster selling into pops would be my first sign of cooling off.

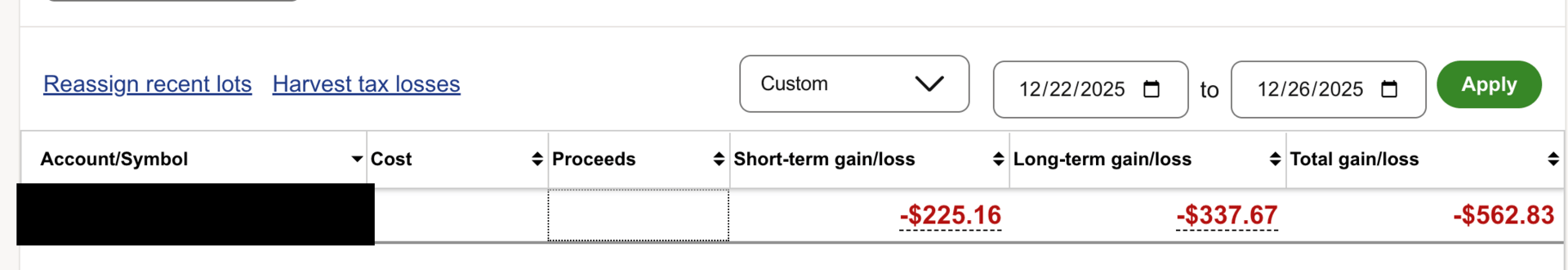

SPX Focused 30 Day Challenge

Even with a few consecutive days of a smooth rise, my results for the week were negative.

12/22/25 to 12/26/25

Two main issues:

I didn’t stop while I was trading well. I turned some initial small wins into “not enough,” and I tried to force “just one more”.

I’m still traveling this week and rushed last minute trades when I knew I’d have to step away. Instead, I could’ve taken the first small win and stopped, or skipped trading altogether. The lack of focus cost me.

This round, my data was clouded by poor execution. Next week I’m following my plan to a T, so I can actually verify whether the one-asset focus and my new entry criteria are working, and whether my first week’s win rate holds up.

For those who celebrate, I hope you had a very Merry Christmas and you have been enjoying the festivities, friends, and family. Have the happiest of New Year’s (my favorite holiday!) and if you’ve want to continue the conversation on any of the topics discussed today, I’d love to hear from you!

Cheers,

Emanuela