- The Trader Reset

- Posts

- A Top Trading Week

A Top Trading Week

Not because of my P/L, but because I got a glimpse of freedom.

SPX Review and Outlook

EOW Stats

High: 6,861.59

Low: 6,720.43

Close: 6,834.49

Change: +0.10%

ATH: 6,920.34 (Oct 29)

Weekly View

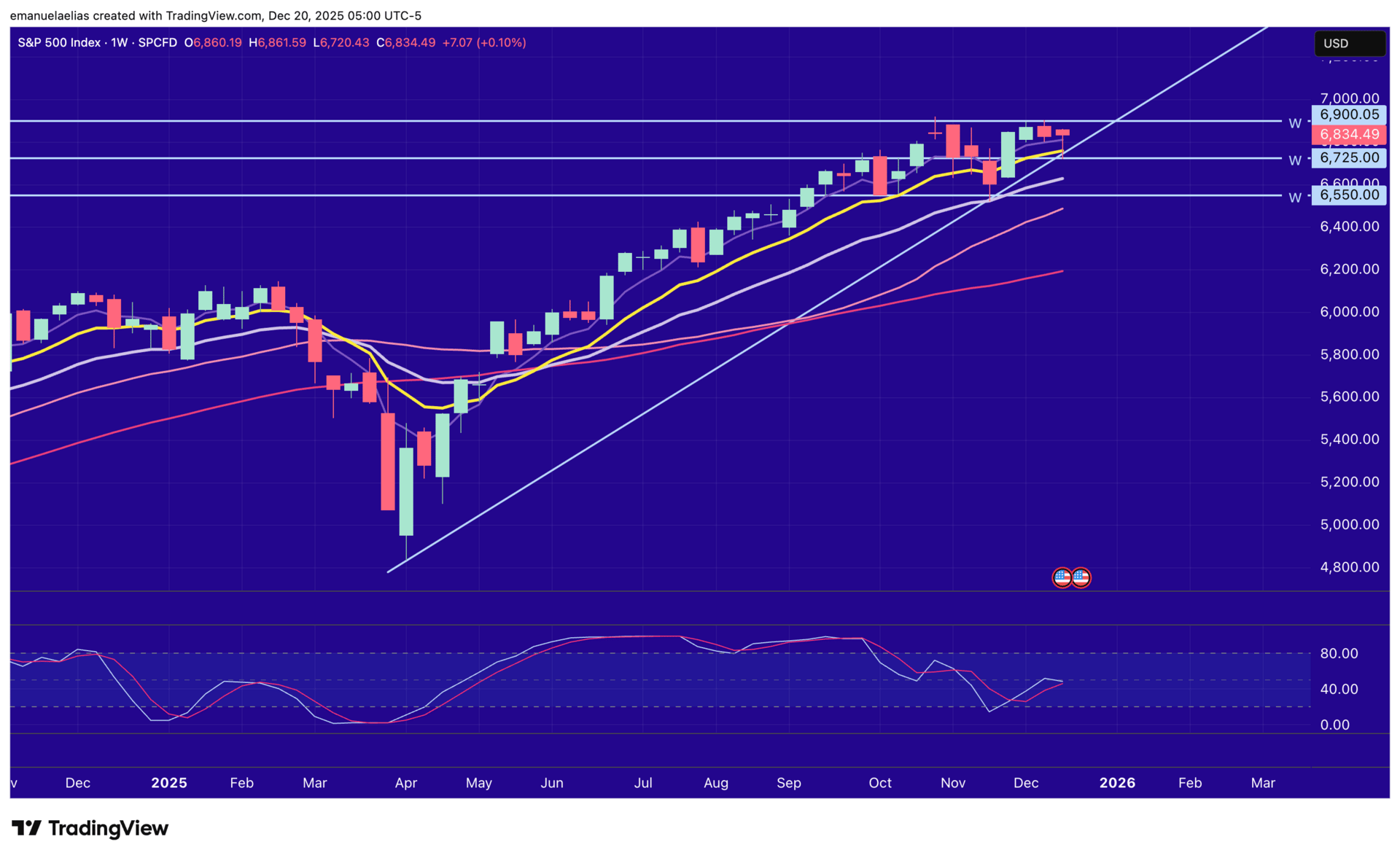

Zooming out to the weekly, we can see a range from 6,550 to 6,900. We’ve rotated down into the lower half and back up into the upper half over the last few months. After the mid-November breakdown, we popped back above the midline and have been holding. This is our third week moving sideways.

SPX Weekly

I missed drawing this uptrend line from late April. I didn’t see it until I started to write for today’s newsletter. Anchored in April, I connected it to the mid-November dip. We pivoted off that area on Nov 21, and we came back to retest it again this week, right where the weekly 10 EMA is sitting. Friday tapped that confluence again (trendline + 10 EMA), and buyers stepped in late week from that area. I so wish I saw this earlier. It would have given me a little more confidence to build my position Thursday and Friday.

Going into next week, if I had to pick a direction off the weekly alone, I’m leaning bullish, mostly because buyers defended that 6,725 area and stepped in off the 10 EMA and uptrend line. But I’ll lay out both sides, and keep in mind we could remain range bound.

Daily View + Scenarios

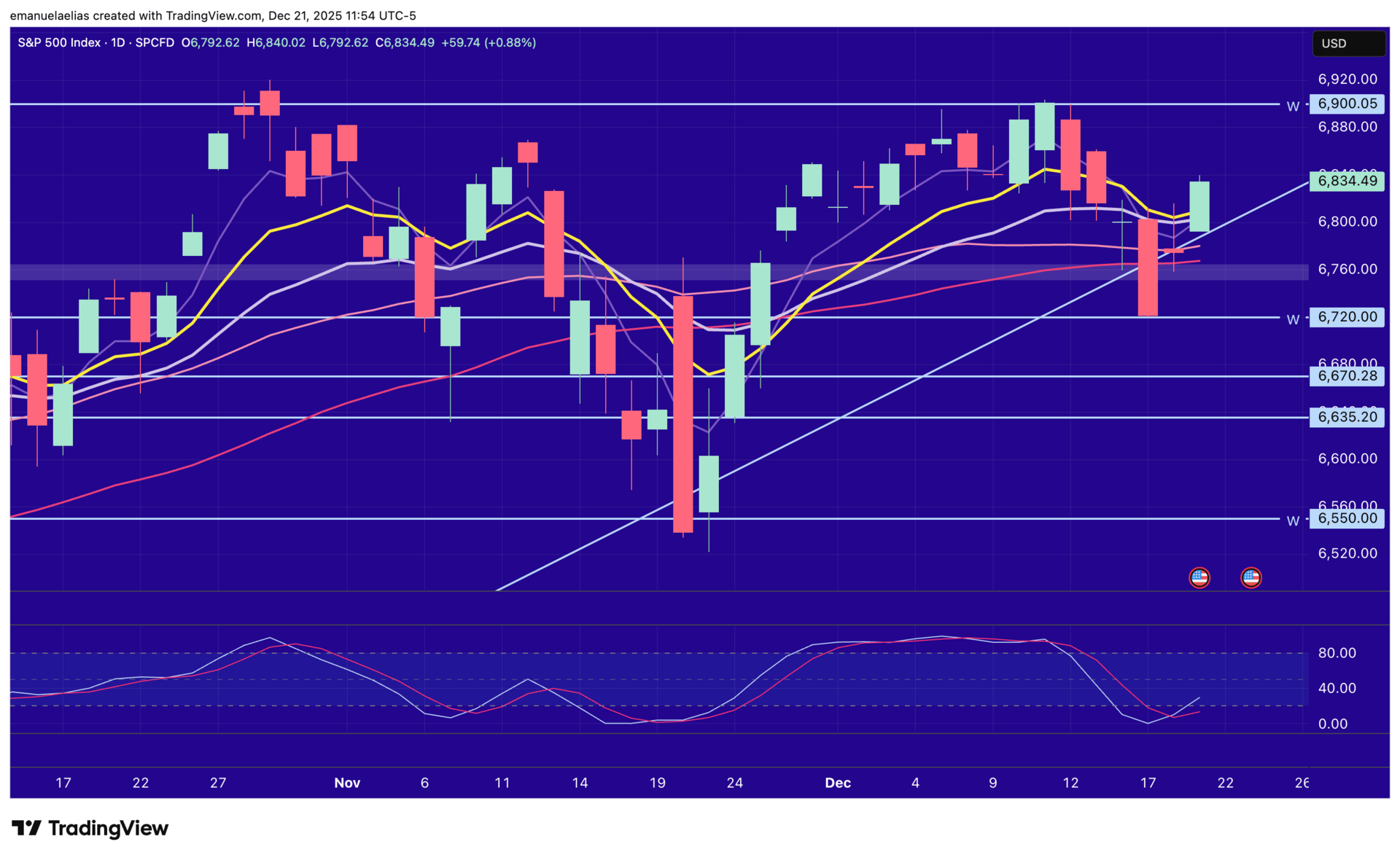

Zooming in to the daily chart, I adjusted the weekly key line to the low of Wednesday’s candle. We sold hard down to that area, then pivoted back up and reclaimed the moving averages.

SPX Daily Chart

Upside Scenario

As long as we hold above or near the shaded area (roughly 6,760 to 6,780), I’m open to pullbacks being buyable to the upside.

I can see us working back up toward 6,900, with resistance likely showing up a bit before that in the prior wicky/noisy area.

If we do get there, we reassess. 6,900 is still the ceiling.

Downside Scenario

Lose the shaded zone → 6,720

Break 6,720 and no quick reclaim → 6,670 → 6,635 → 6,550

Update on my SPX-only Trading

This was week one of my 30 days of SPX-only trading. I can tell I’m still building my confidence back up, and I still feel nervous when I’m in a position. Instead of fighting that or trying to “power through,” my focus this week was to meet myself where I’m at, psychologically and neurologically, and also where I’m at in real life (traveling with my family). I wanted to fold trading into my life, not have trading hijack it.

So I kept it simple and took tiny intraday trades for two reasons:

to work on precision with my entries

to close trades quickly so I could stay present in life

Here’s how it went:

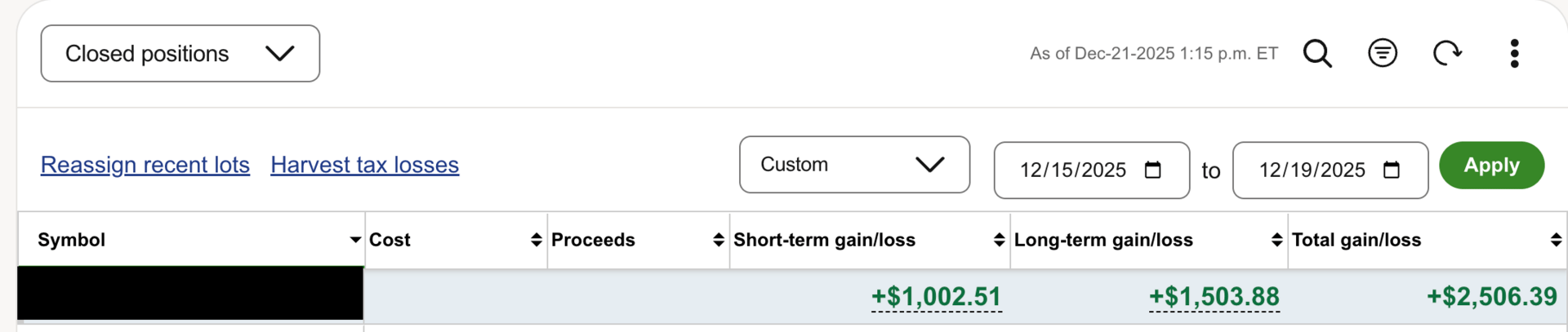

12/15/25 to 12/19/25

This was one of the best trading weeks I’ve had in a long time, not because of the money, but because I felt free. It gave me a real taste of trading as something that supports my life, instead of something I manage from an anxious place. I felt in control, I wasn’t carrying trades around all day, and I wasn’t checking my positions every five minutes. I had one chart to review at night which minimized my charting work. I stayed present and thoroughly enjoyed my time out and about.

I know it’s only week one, so I’m not making it mean more than it is, but it was the first time in a while that I didn’t feel defined by my drawdowns. I felt like, I am where I am, and I’m moving forward from here. Trading felt like part of my life, not an all-consuming entity, and that’s the direction I’m protecting.

No jots this week, but have a few really great notes brewing for next week’s newsletter on trading addiction!

Small Bites > Massive Size

Cheers,

Emanuela