- The Trader Reset

- Posts

- 259% YTD Return

259% YTD Return

How structure and execution held up through the messy parts

The results are in!

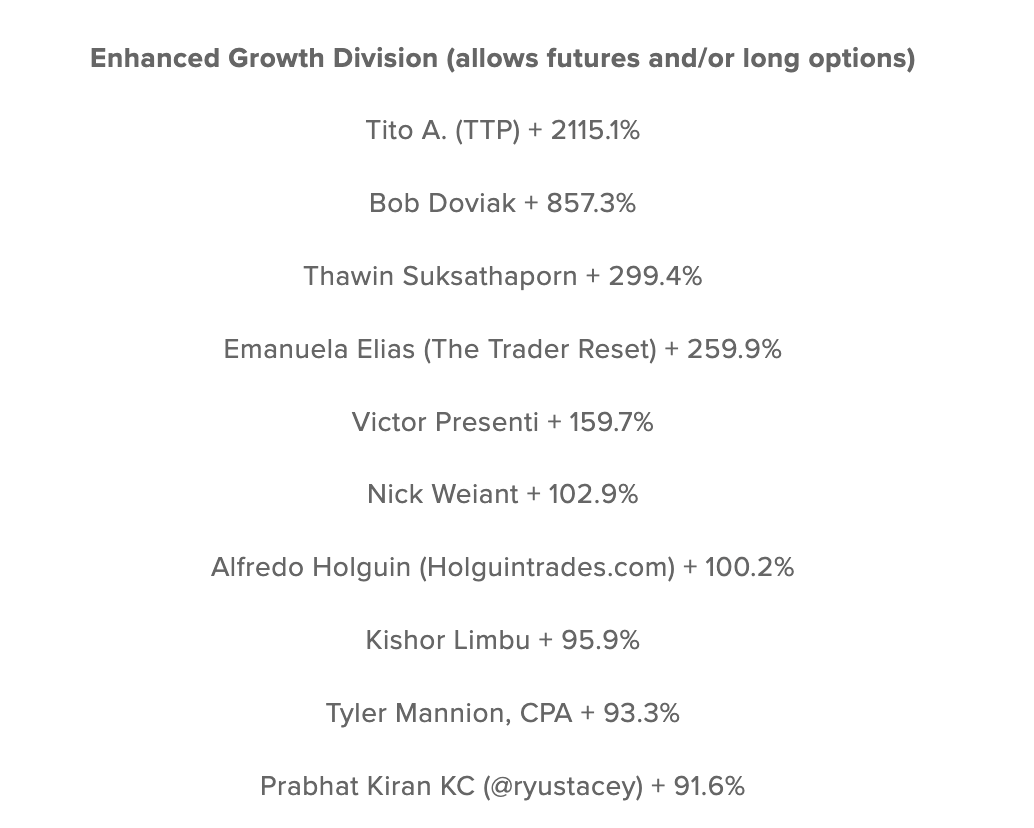

If we can all momentarily ignore the top two astronomical returns, I finished +259% YTD, placing 4th in the Enhanced Growth Division in the 2025 U.S. Investing Championship! I’m going to allow myself a real moment of celebration here. 🥂 (But seriously, Tito, can you please trade my money? 😂)

Top 10 Standings in US Investing Championship. Find full standings here.

This result includes everything. The drawdowns, the stretches that kept me up at night, the periods where nothing felt clear, and the moments where the real work was slowing down, managing tilt, and adjusting my plan.

This is the first year of my public track record. 😅🥳 I still remember this rando on the internet telling me that consistently returning 50% year over year wasn’t possible. That stuck with me because I’ve been returning well over 50% for years privately, and it started happening when I built real structure through my trading plan and system.

I’m sharing this to encourage you and to show what’s possible when you work intentionally with structure. Beating the market (at minimum) becomes a realistic target when your structure is clear, your decision-making is repeatable, and your process holds up through the messy parts.

P.S. If you struggle with inconsistent results, like having super strong weeks and then giving it all back, I’ve opened a community that’s focused on building your trading plan and system, the structure that will turn your effort into repeatable results. Join here!

I’m grateful for my family and friends, and especially my partner and my mom, who helped me stay grounded through some wicked drawdowns and more than one identity crisis. We did it!! 😭😂🥳

I’m looking forward to continuing to build from here, but for now, let’s get on to some charts.

SPX Review and Outlook

Alright, I decided to just continue with my SPX analysis right here in my newsletter (vs fully segmenting it out), and this week I also have a bonus analysis on NFLX.

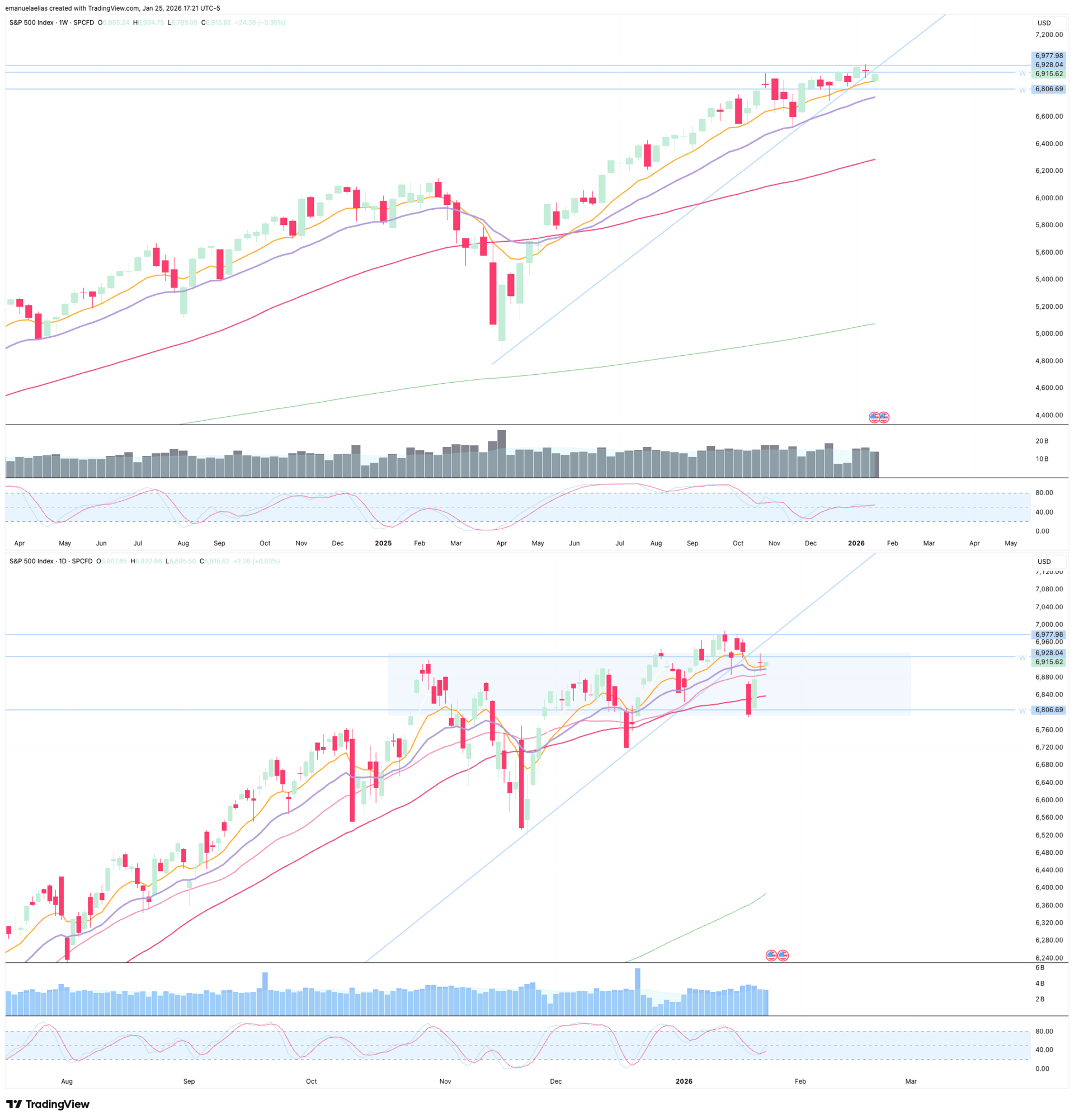

SPX Weekly and Daily Chart

Looking at both the weekly and the daily here, the big picture hasn’t changed much. On the weekly chart, price briefly undercut the uptrend line that was anchored from the April 2025 low. Briefly undercutting a trendline or key level happens all the time without actually shifting structure, so I’m not treating that single thing as a trend change, but I’m definitely aware of it.

I’ve marked two key levels on the weekly chart, both have multiple touch points, but more importantly, these are the edges of the range we’ve been trading inside since October 2025, ~6928 on the upside and ~6806 on the downside. So even though SPX has continued to drift higher over time with higher lows and higher highs since the November dip, price has not broken out of this range in a decisive way. Structurally, this is still range-bound, and my bias is still neutral.

Bullish scenario

Price reclaims 6928, holds above it, and starts rising above the range rather than popping up and then backsliding

Follow-through looks like closes above 6928, pullbacks that stay supported above it, and then continuation back toward the ATHs

If we push through those highs and hold, that’s our shift back into “making new highs” mode, and it can change the quality of follow-through compared to a range

Bearish scenario

Price pushes into 6928 and fails to hold above it, meaning we see rejection and rotation back down into the range

If we press up into 6975 to 6980 and start hesitating, stalling, or failing to make progress, I’m watching for selling back into the range as well

A cleaner bearish shift would show up as follow-through selling that rotates price back toward the lower edge near 6806, with 6806 staying as the main line that helps define whether this remains a range or starts turning into heavier selling

How I’m trading it right now

Because we’re still dealing with a lot of sideways action inside the bigger structure, I’m keeping my focus on the hourly chart more than the daily. I’m still putting on trades, but I’m managing them more actively and taking them off sooner.

Is NFLX a buy?

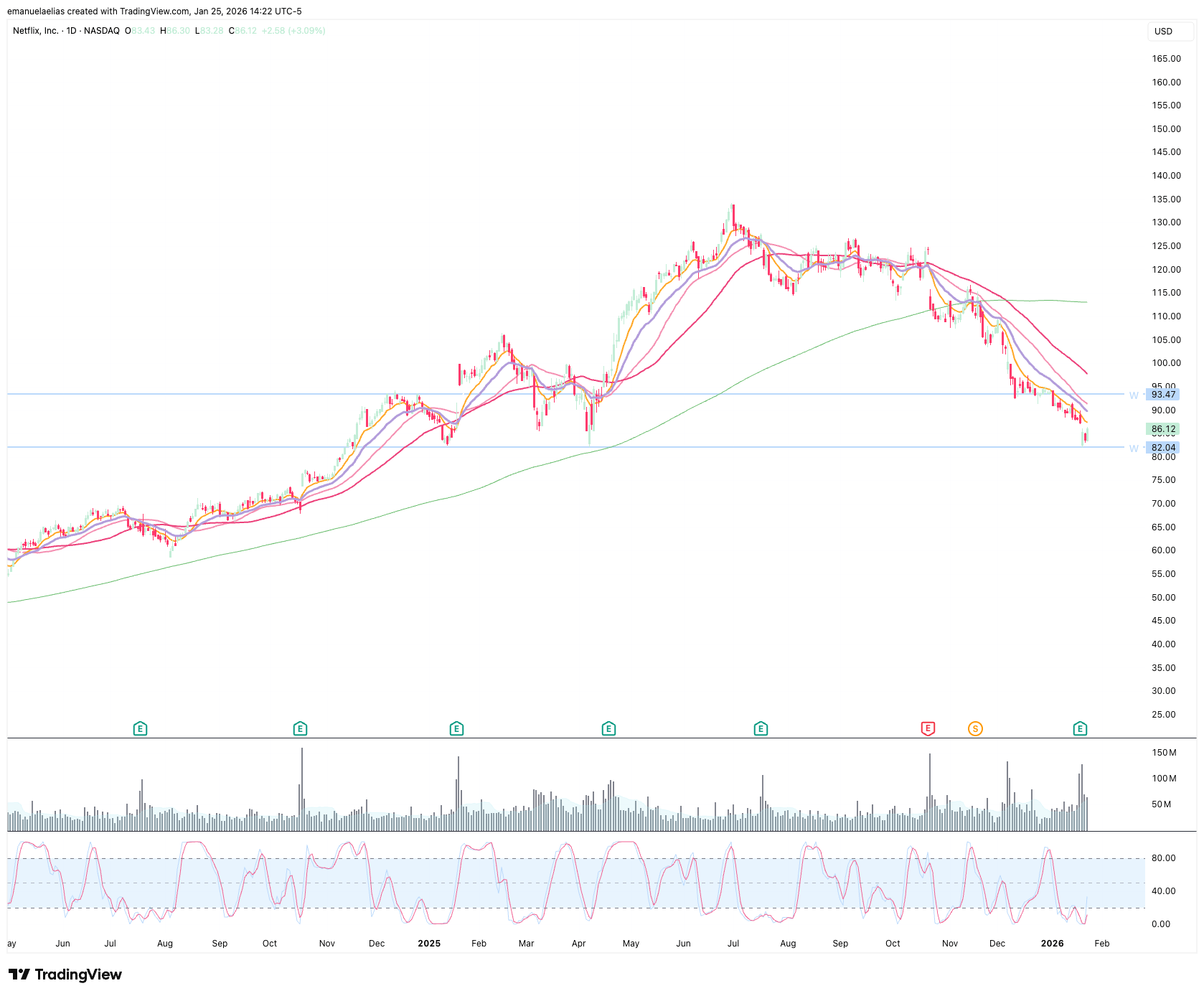

I wouldn’t typically be considering anything still in a downtrend, but here I am. 😂

Last week, I made this video sharing my idea, and you can view it here. My bullish idea is basically a “pivot / base trade” off a higher timeframe support zone. If we get more of a v-bottom base, we could see a significant move over the next few weeks. If we build a longer base, it could be months until we get a sustained rise. And all of this assumes we are going to pivot from the weekly support I’ve marked.

NFLX Daily Chart

Key downside levels and invalidation

82 - 86: This lines up with prior weekly touch points, and it’s the level that keeps the “we might be building a bottom” idea intact. If price loses 82 and cannot reclaim it, the trade shifts from base building to failed support. Any sustained price action up and away from this area will give me confidence we are at least done going down.

Some targets to the upside:

93-94 Previous weekly resistance that later became a breakout area with a strong run up.

100 A psychological level, and typically where we’ll see hesitation.

110 to 112 Where the 200 SMA is sitting, and it lines up with the idea of getting back into the bigger uptrend structure.

And if it really gets going, 120 to 125 is that prior messy consolidation zone, which turns into the next question of can it hold inside that range again.

How I’m approaching it

Last week I started building a new stock position. If buyers keep stepping in and we start seeing real stability, I will continue to add. I plan to trade call options along the way, and will consider an occasional put at key levels. If we undercut 82, I will just sit out again.

Alright y’all, it’s been my pleasure sharing this with you today. Just remember:

Structure and execution > the messy parts

Cheers,

Emanuela